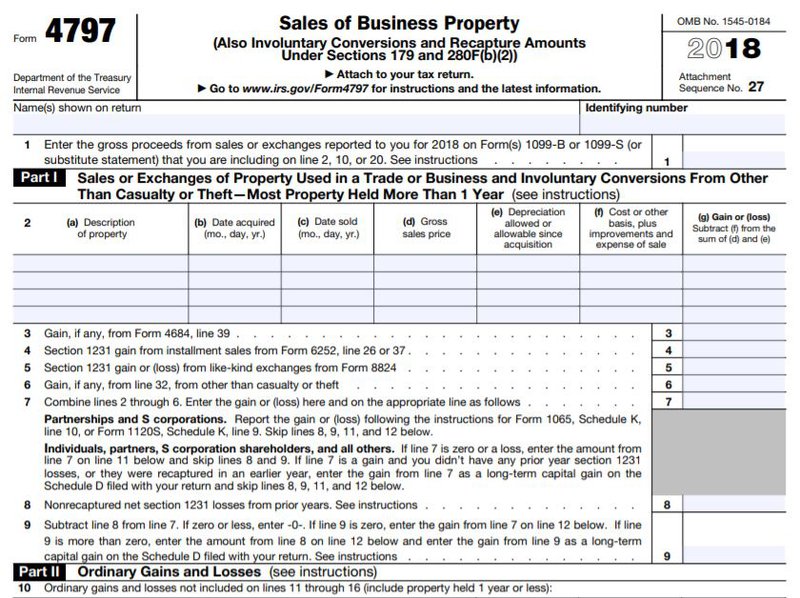

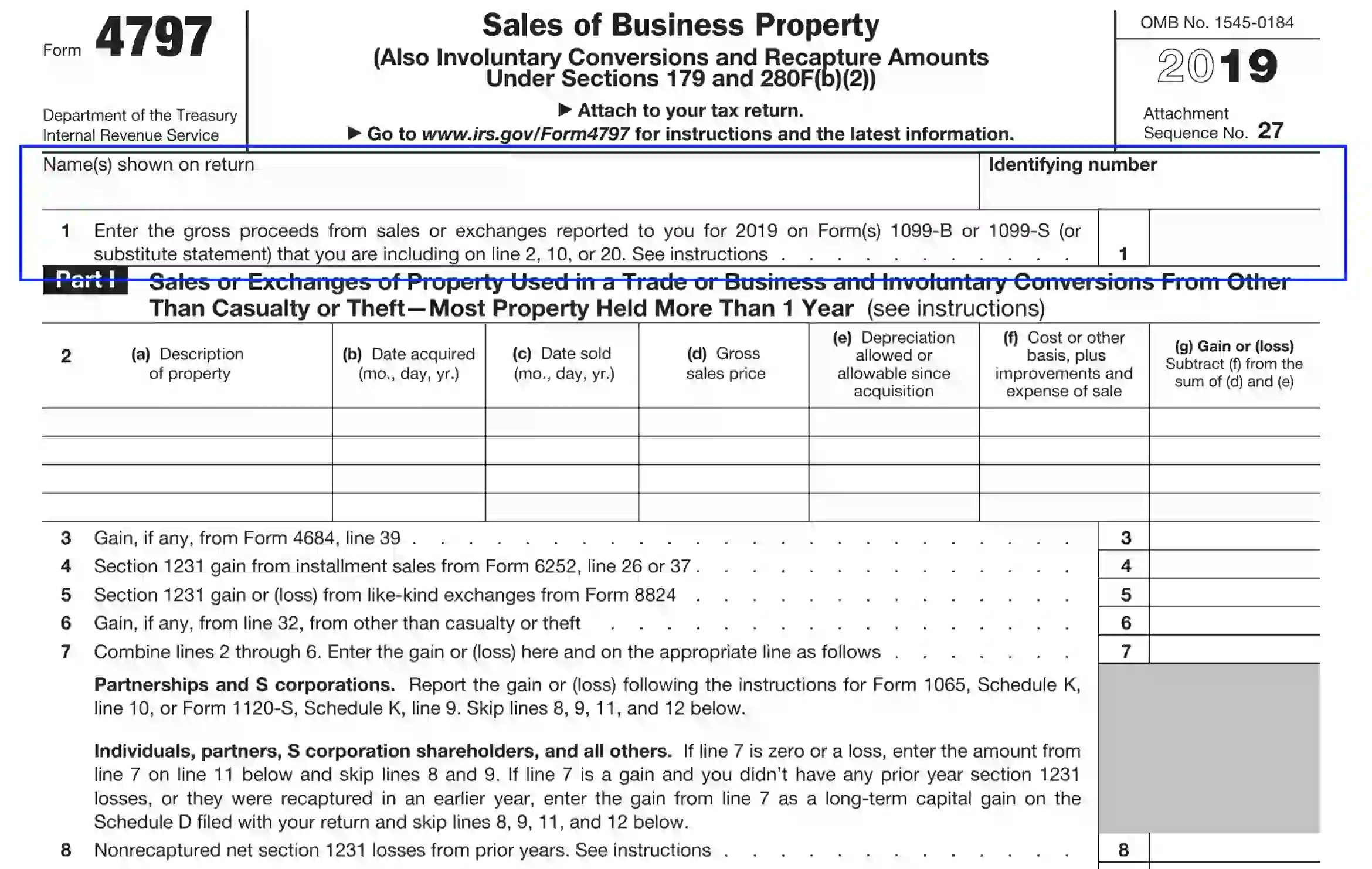

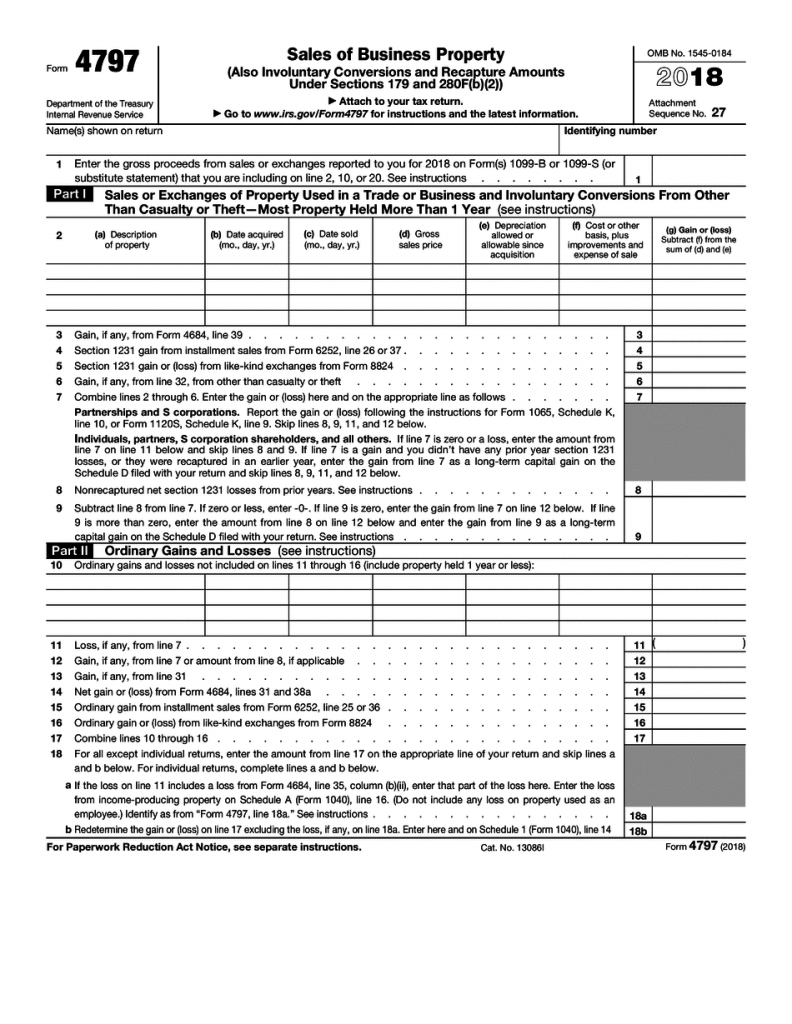

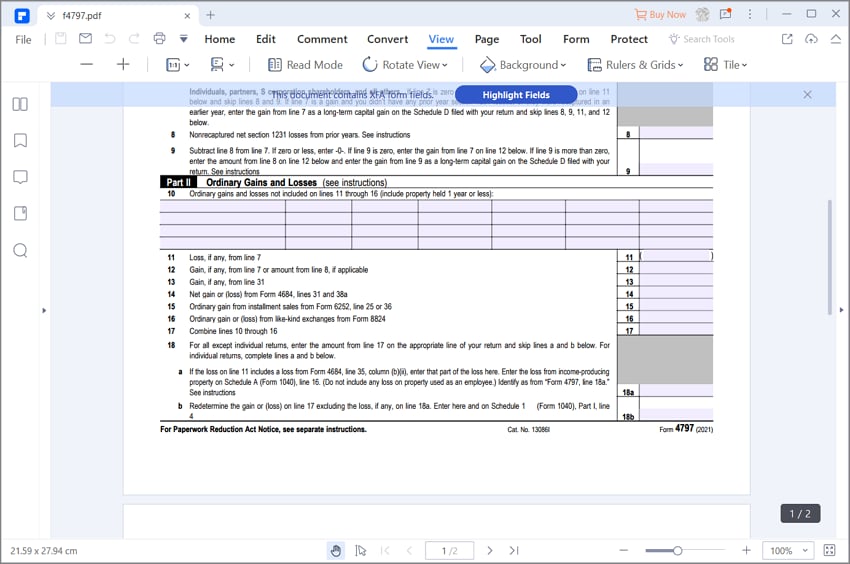

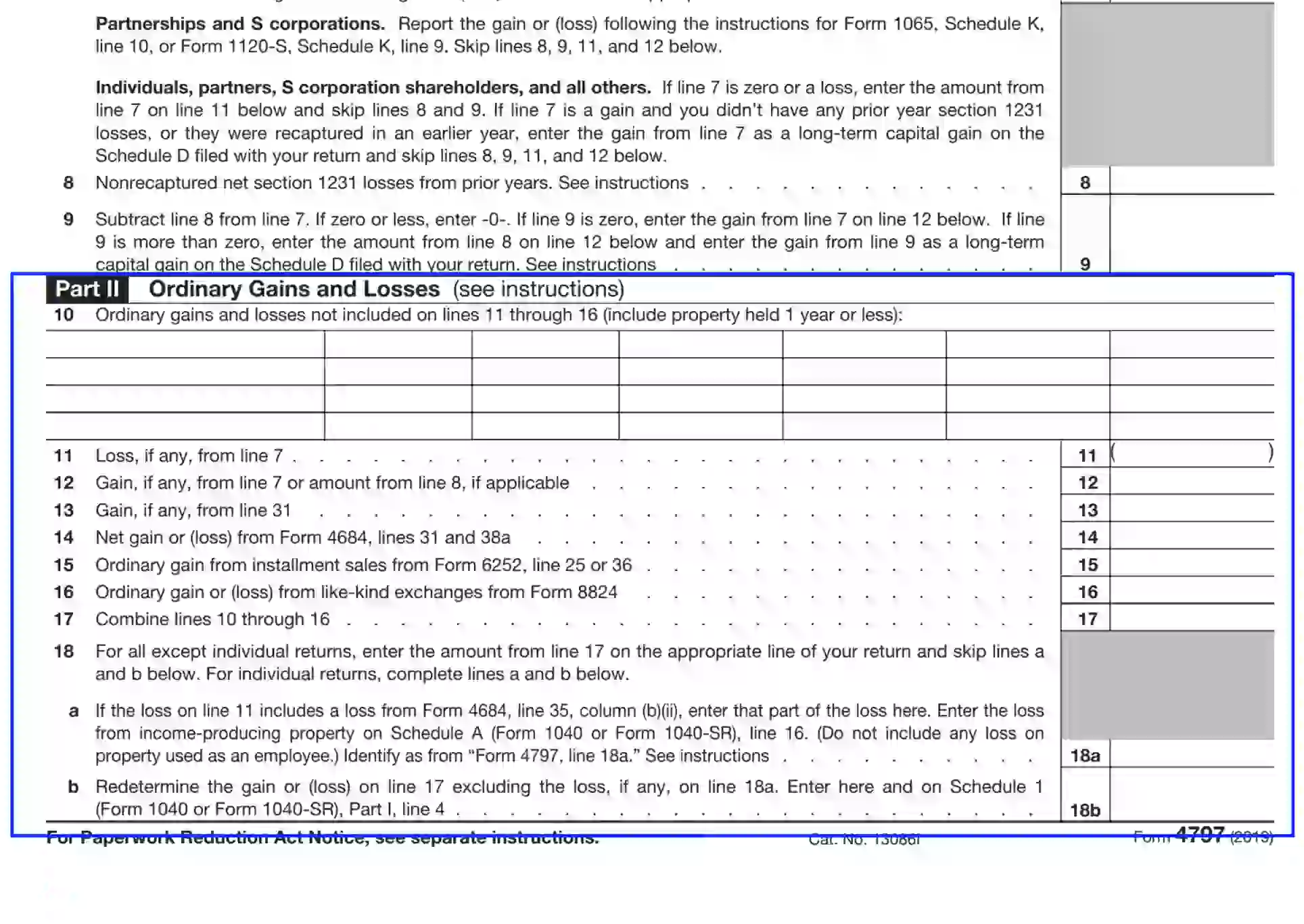

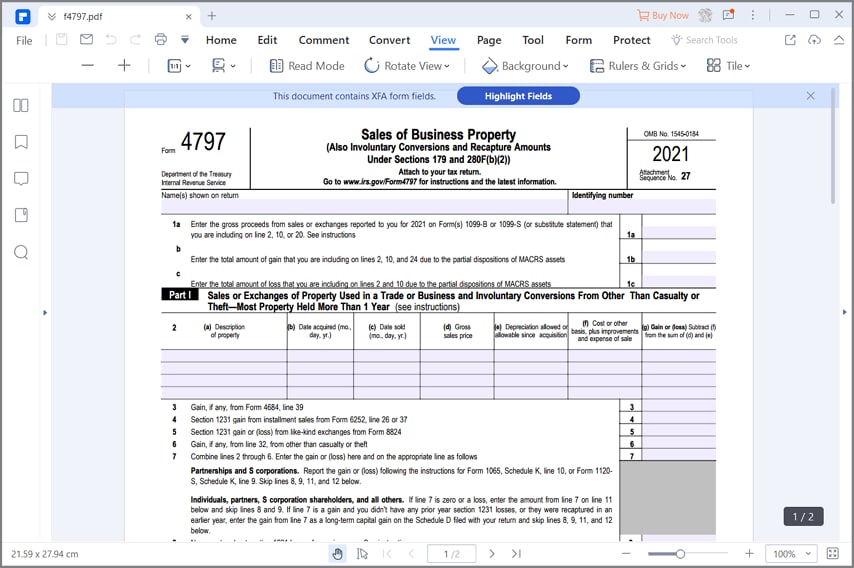

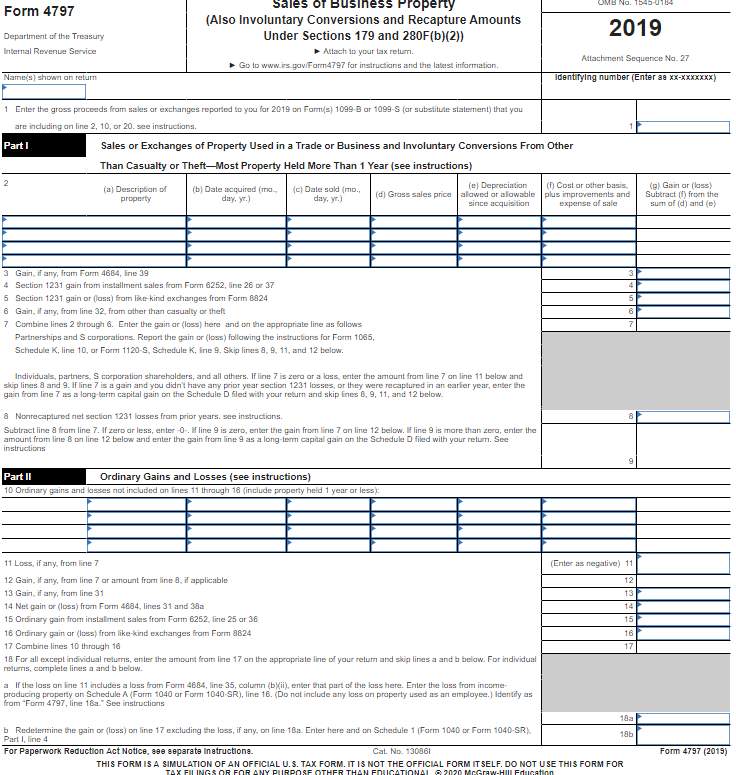

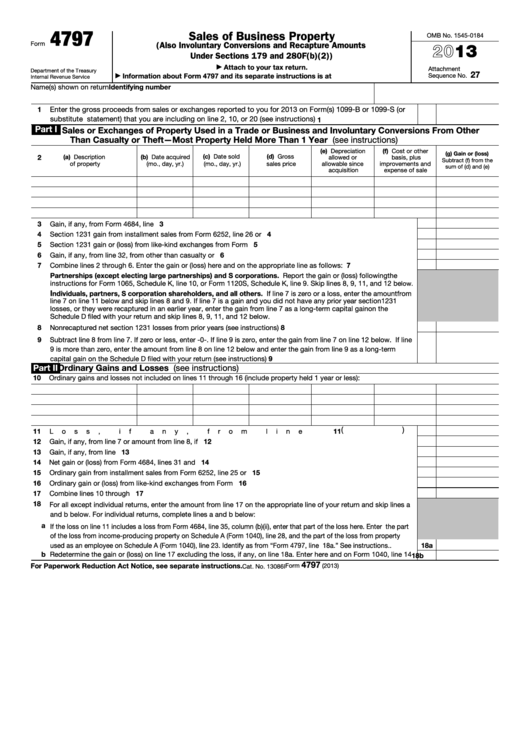

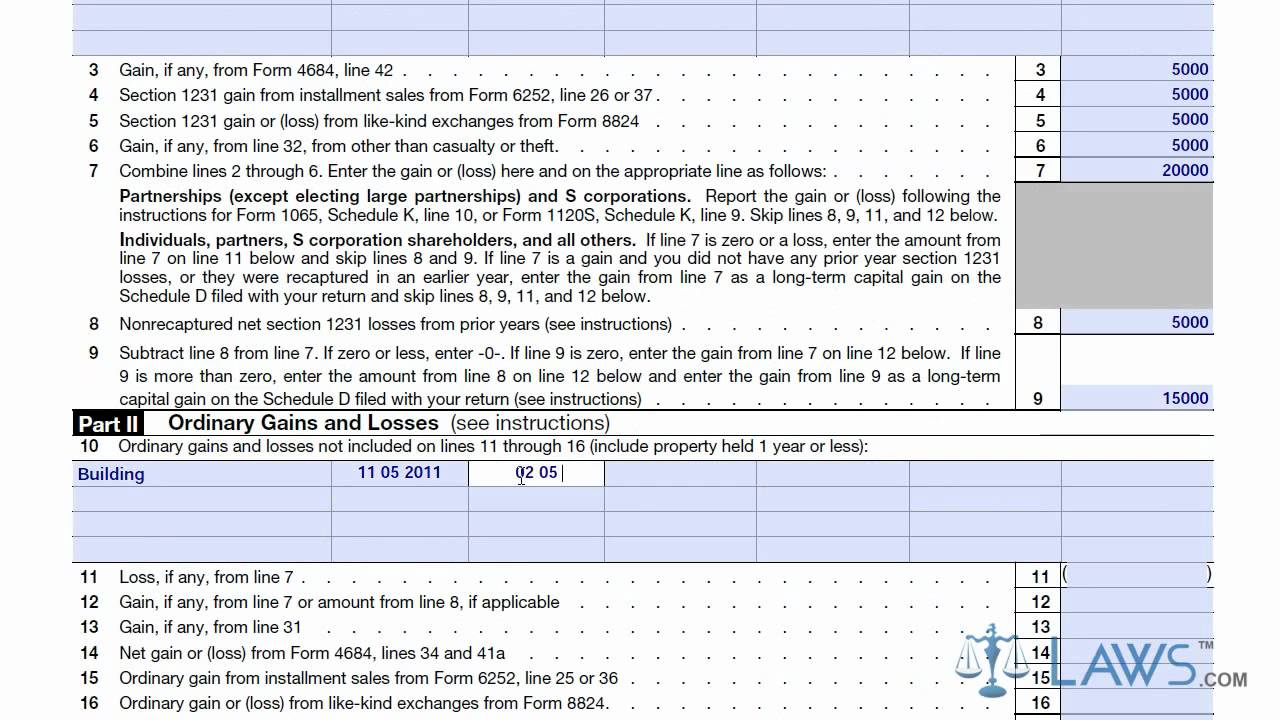

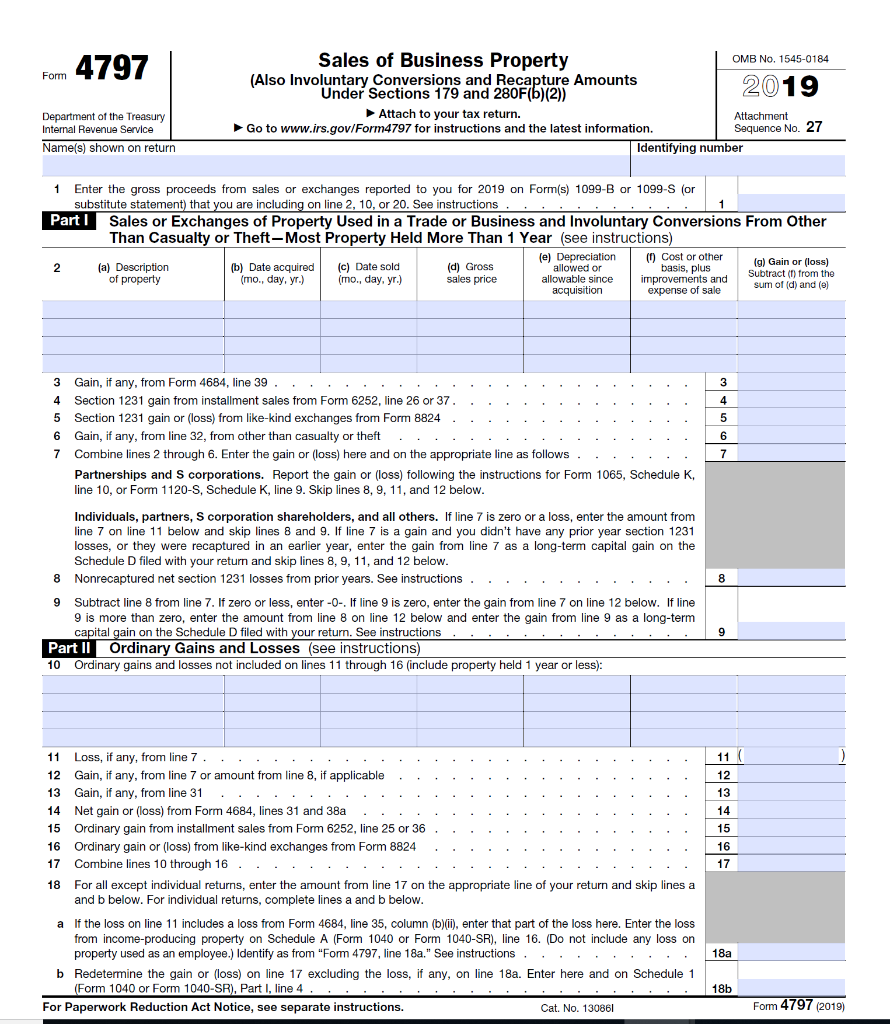

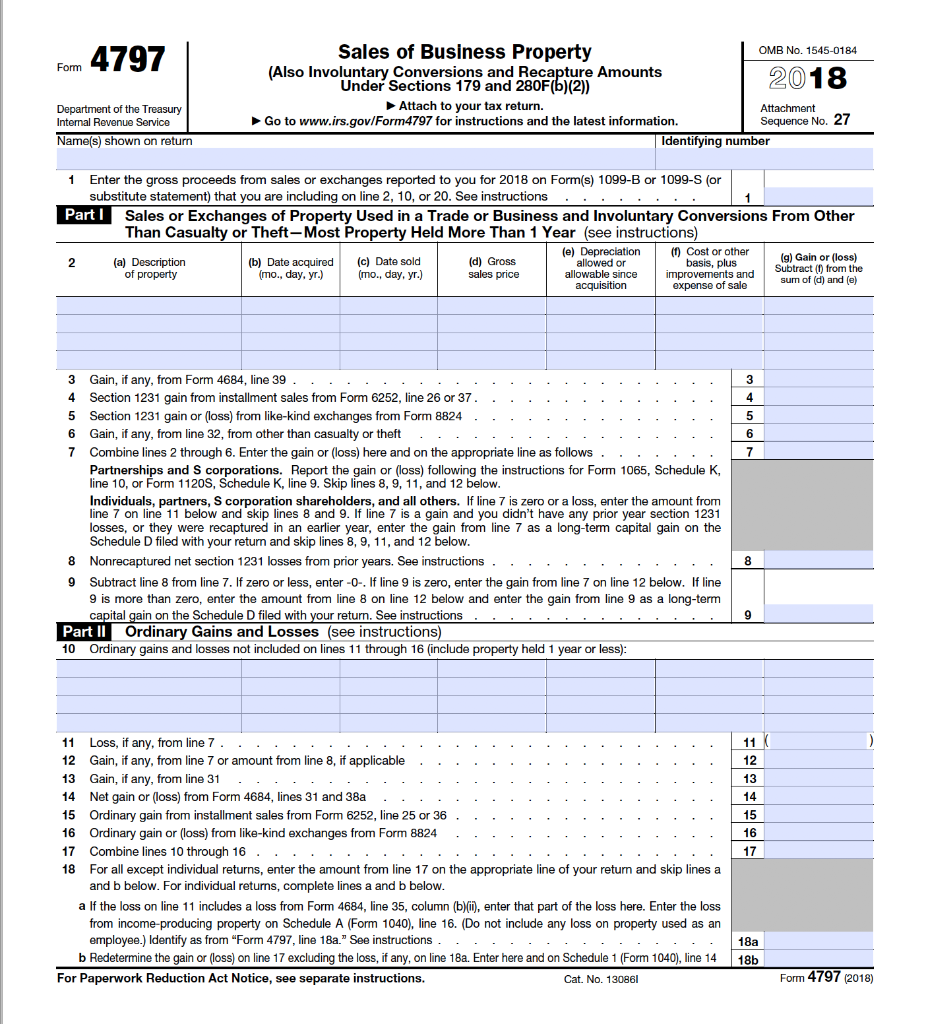

· From 4797 is used to report transfers, losses and gains associated with business property Form 4797 is a document required by the Internal Revenue Service (IRS) in the United States when people transfer business property or experience gains and losses related toForm 4797 is Used • Gain/loss from disposition of §179 property by partnership or Scorps • Reported by the partner or shareholder • Computation of recapture amounts from §§179 and 280F(b)(2) • When business use drops to less than 50%Following the instructions for Schedule K1, enter any amounts from your Schedule K1 (Form 11S), box 9, or Schedule K1 (Form 1065), box 10, in Part I of Form 4797 If the amount from line 7 is a gain and you do not have nonrecaptured section 1231 losses from prior years (see instructions for line 8), enter the gain from line 7 as a longterm capital gain on the Schedule D

Irs Form 4797 Fill Out Printable Pdf Forms Online

Mi form 4797 instructions

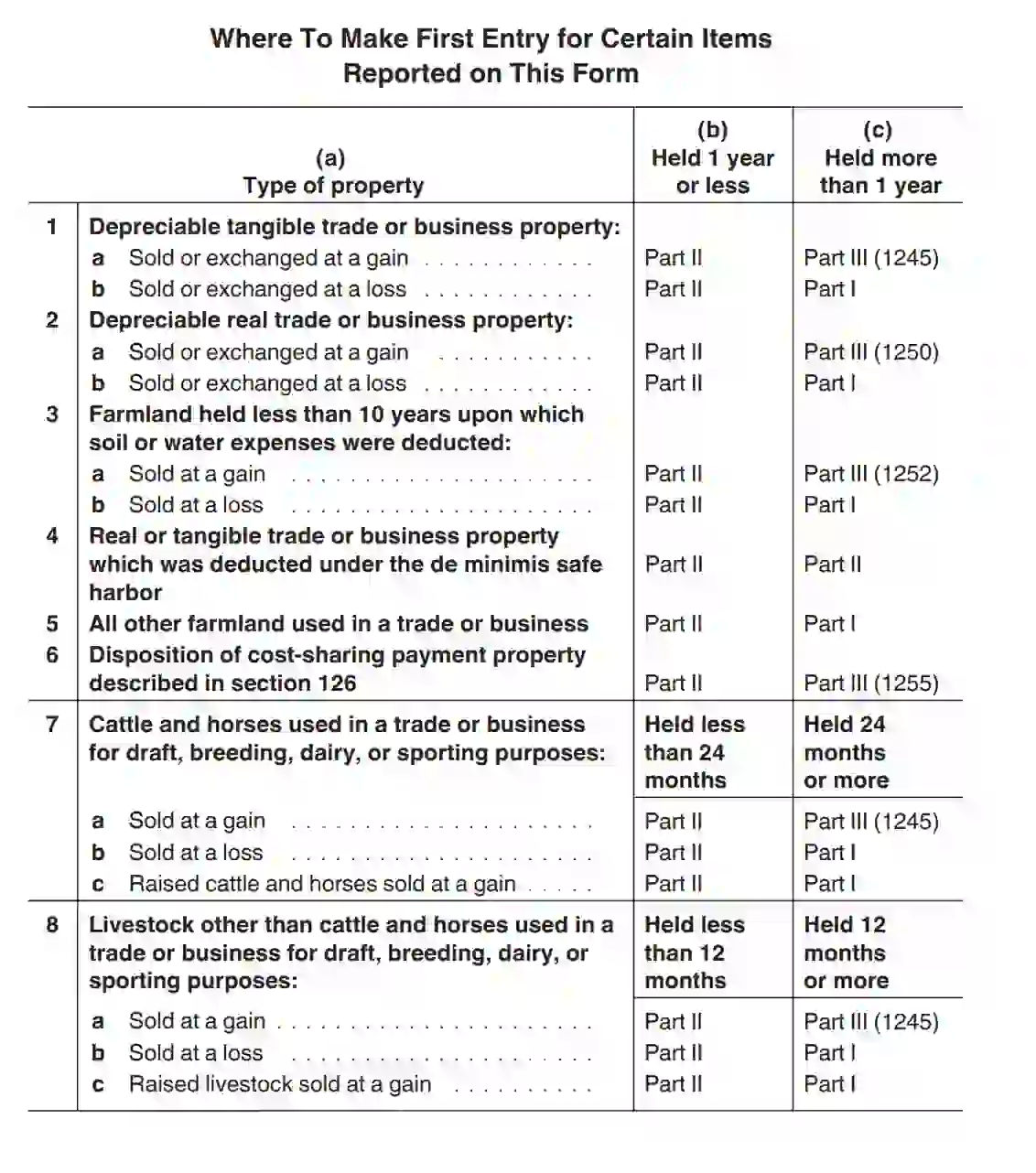

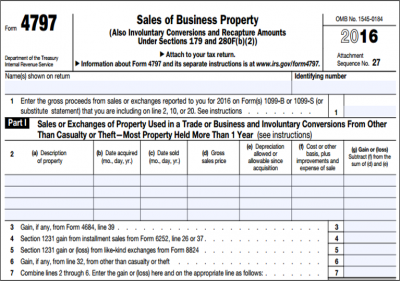

Mi form 4797 instructions-Generally, Form 4797 is used to report the sale of a business This may include your home that was converted into a rental property or any real property used for trade or business Who Can File Form 4797 Sales of Business Property? · Form 4797 is made up of four separate parts Which part of Form 4979 you'll use depends on the kind of property and your gain or loss If the property was held for more than a year, Part 1 Sales or Exchanges of Property Used in a Trade or Business and Involuntary Conversions From Other Than Casualty or Theft needs to be used

A Not So Unusual Disposition Reported On Irs Form 4797 Center For Agricultural Law And Taxation

Select a category (column heading) in the drop down Click Find Click on the product number in each row to view/download Click on column heading to sort the list You may be able to enter information on forms before saving or printing Downloading and printing File formats View and/or save documentsOr Form 6252, line 8 •Form 4797 line 11 or the loss on Form 4684 line 35 column b ii Likekind exchange of a portion of a MACRS asset Form 4797 line 5 or 16 See the instructions for Parts I II and III On Form 49 enter From Form 4797 in column a of Part I if the transaction is short term or Part II

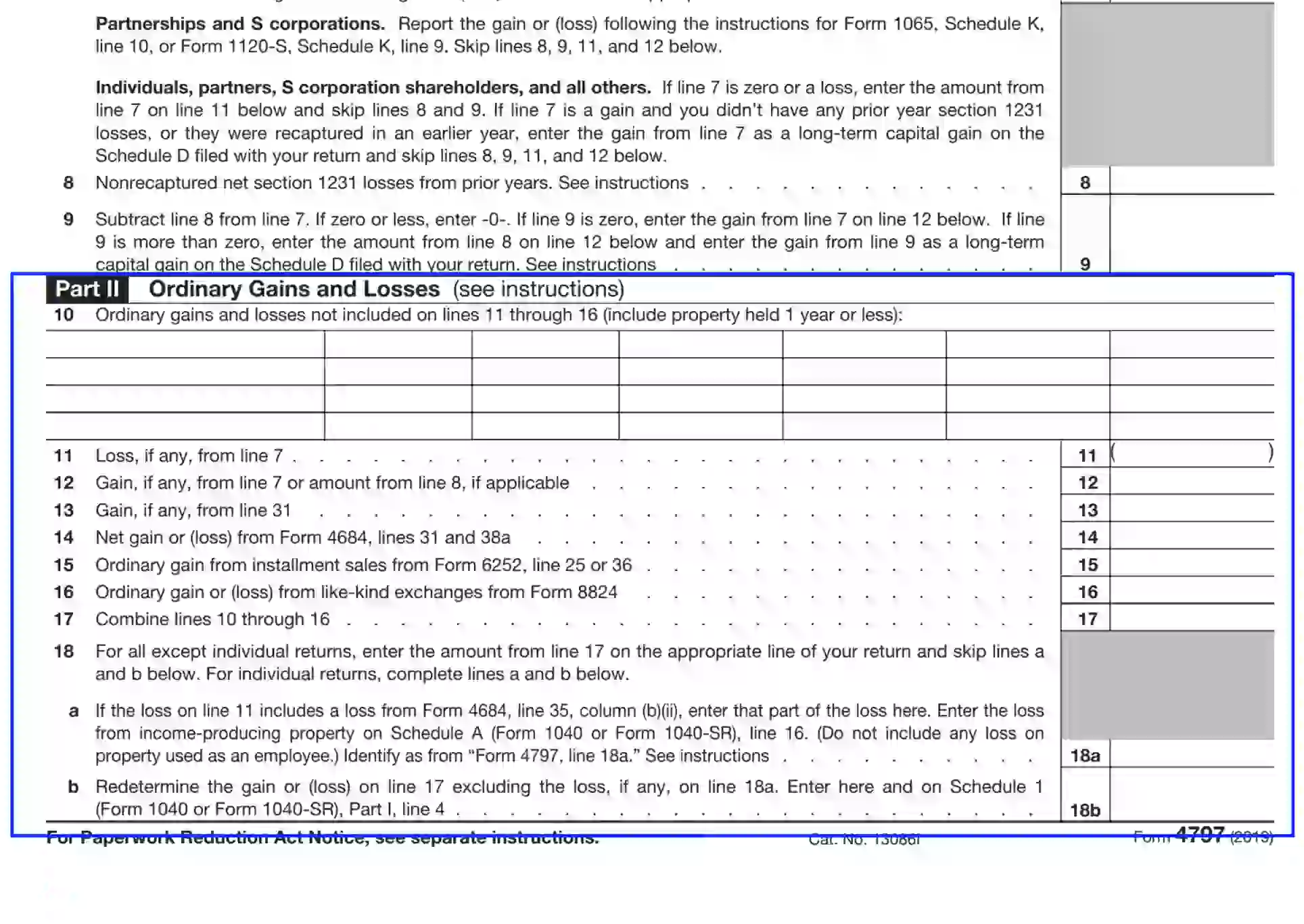

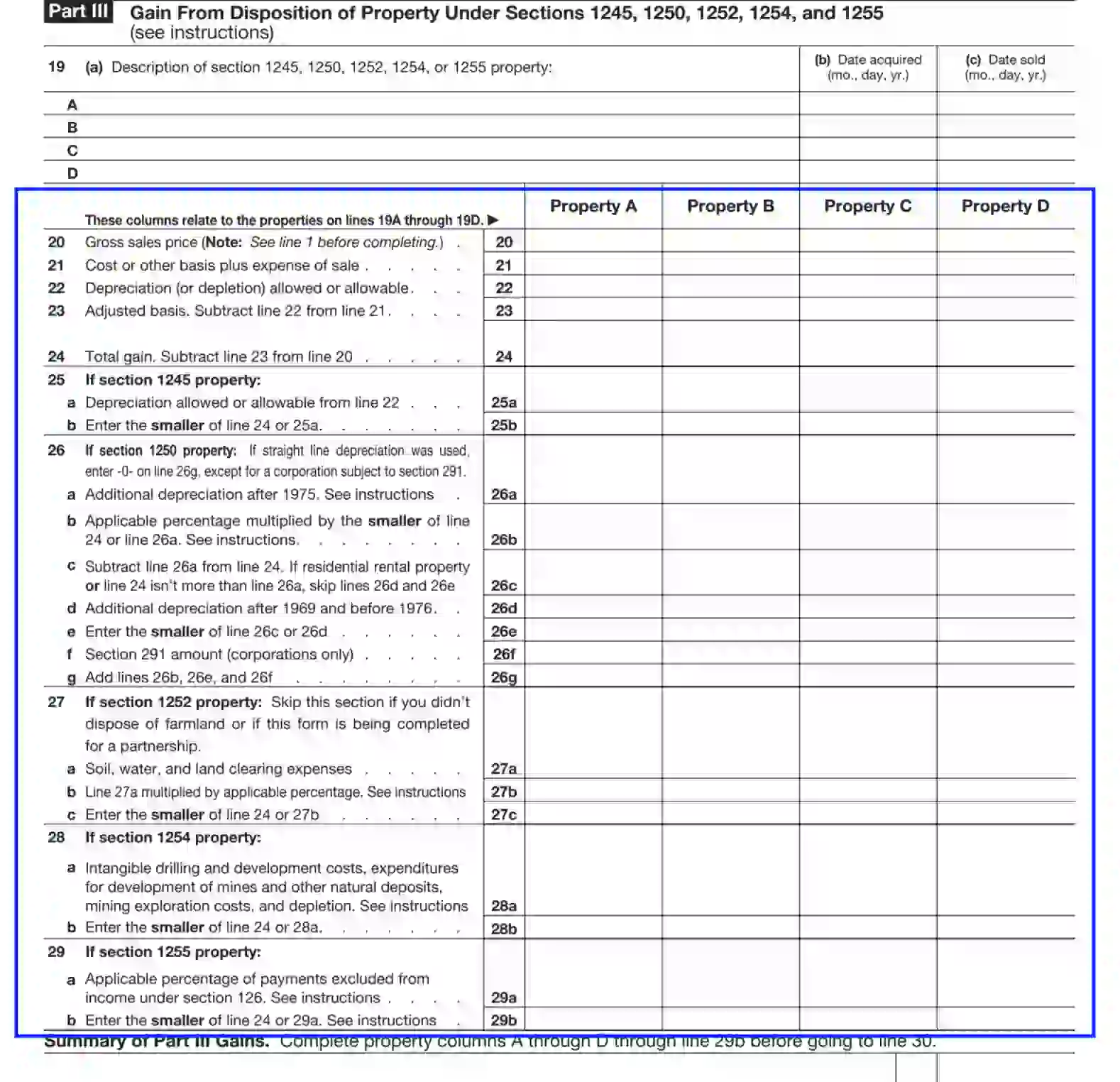

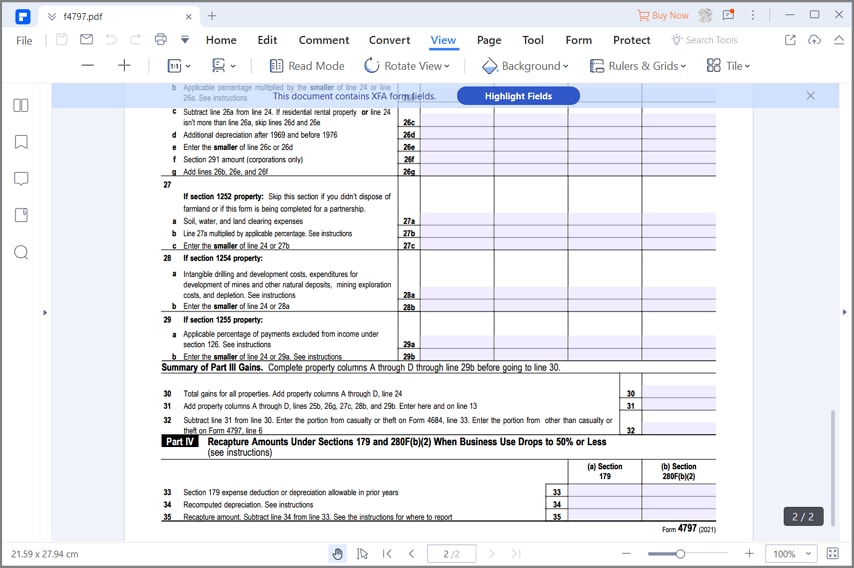

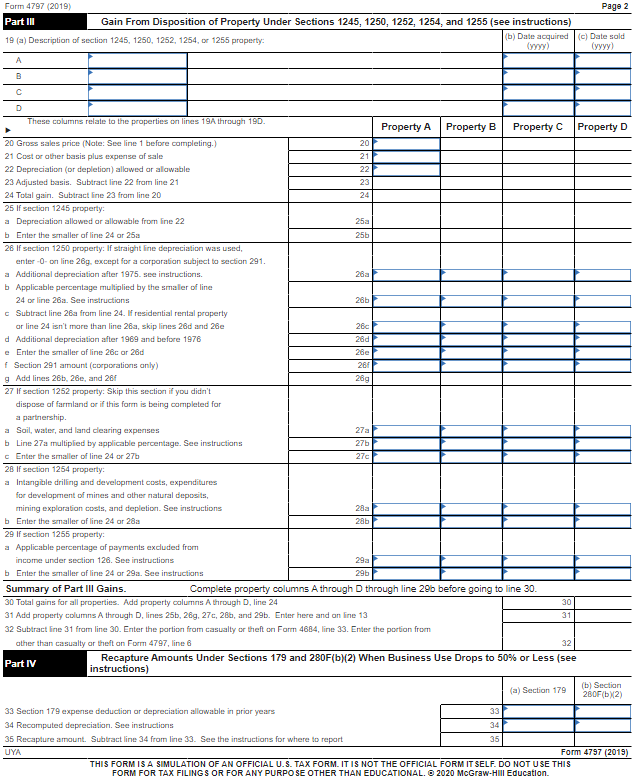

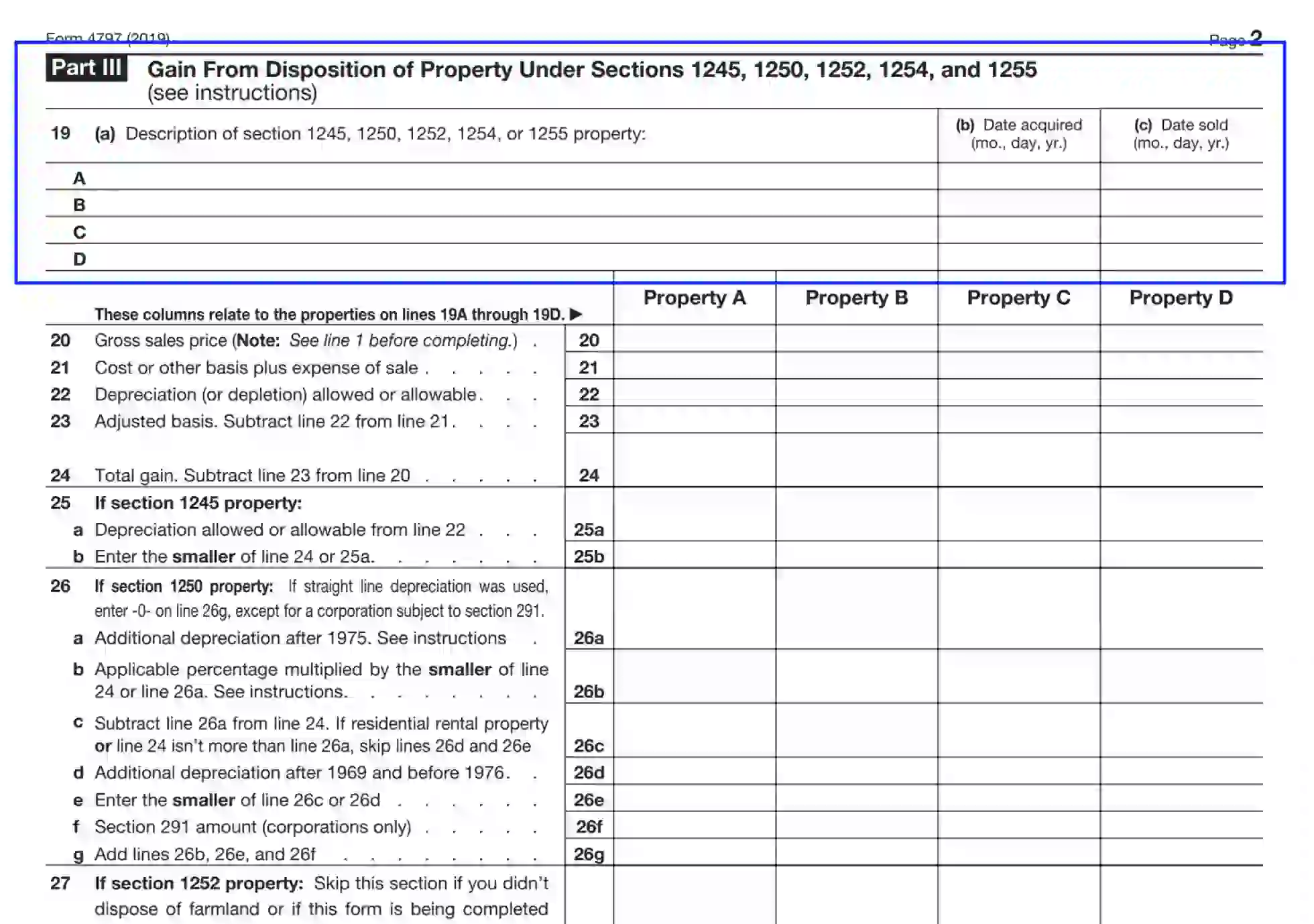

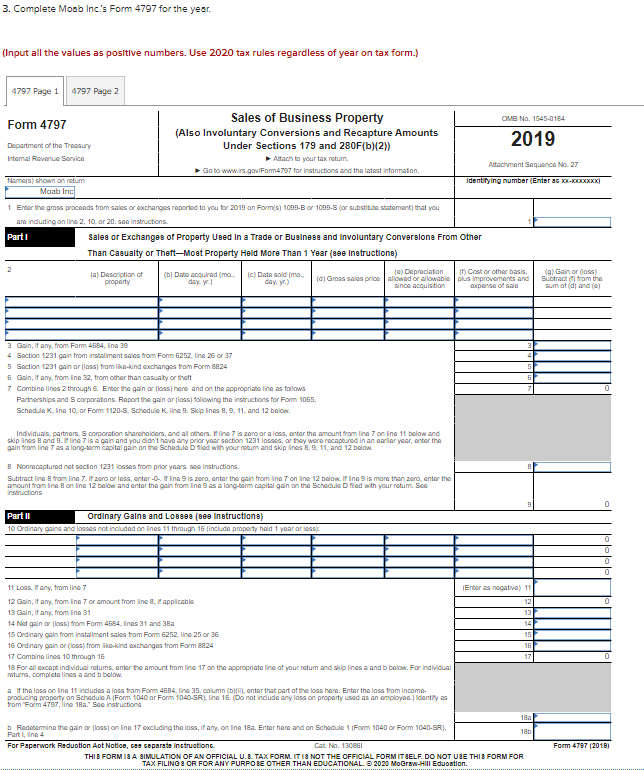

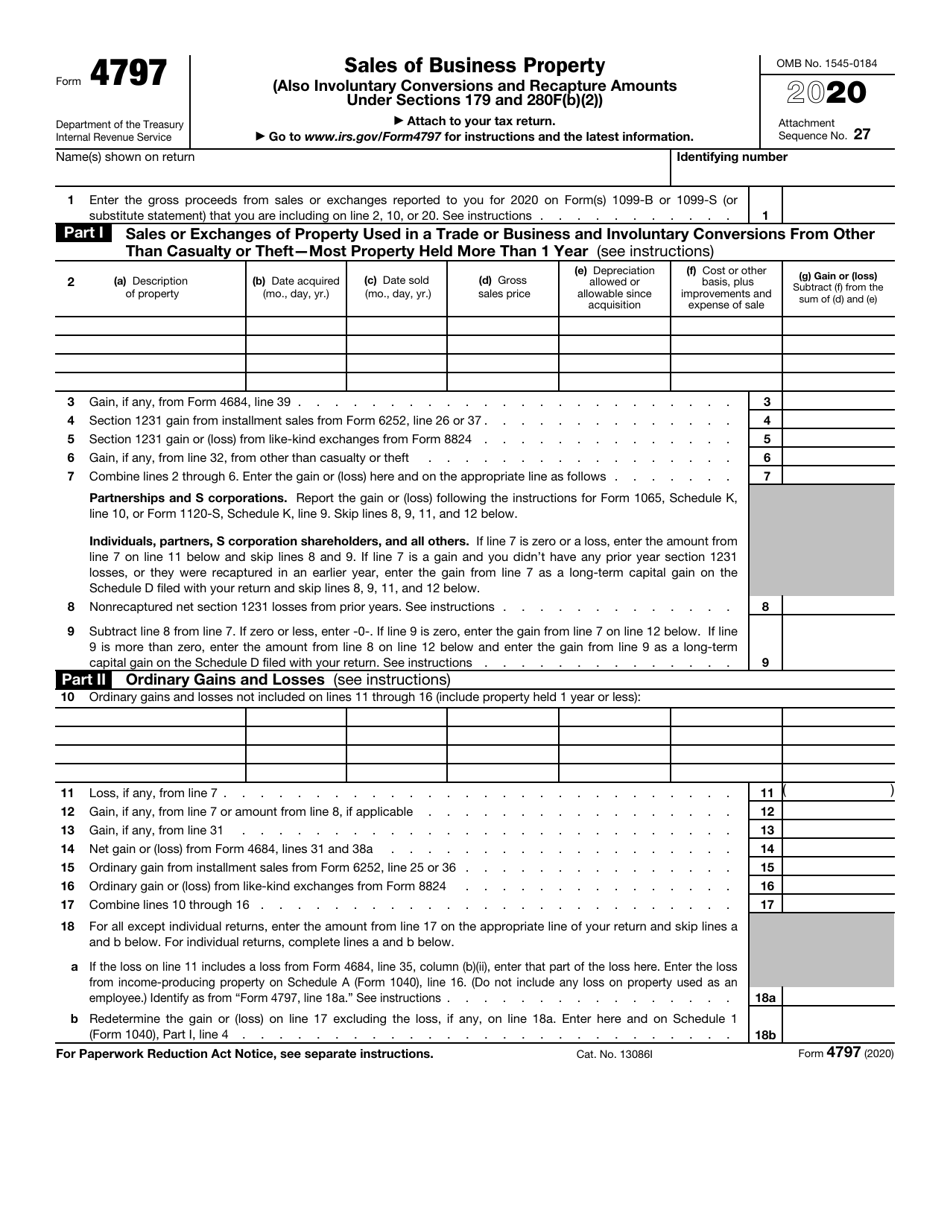

Get And Sign 4797 Instructions Irs Form Form Use Form 4797 to report • The sale or exchange of 1 Real property used in your trade or business;Form 4797 Department of the Treasury Internal Revenue Service Sales of Business Property (Also Involuntary Conversions and Recapture Amounts Under Sections 179 and 280F(b)(2)) Attach to your tax return Go to wwwirsgov/Form4797 for instructions and the latest information OMB No 19 Attachment Sequence No 27 Name(s) shown on return4797 Use Part III of Form 4797 to figure the amount of ordinary income recapture The recapture amount is included on line 31 (and line 13) of Form 4797 See the Instructions for Form 4797, Part III If the total gain for the depreciable property is more than the recapture amount, the excess is reported on Form 49 On Form 49,

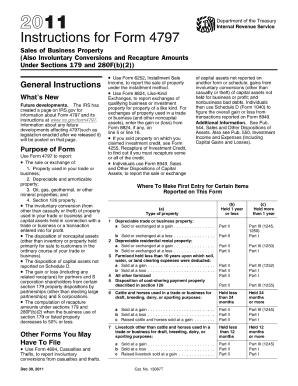

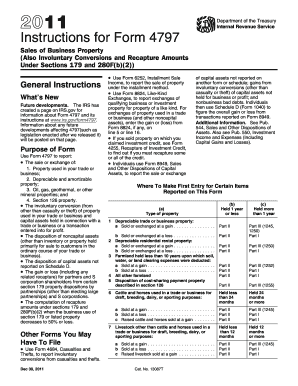

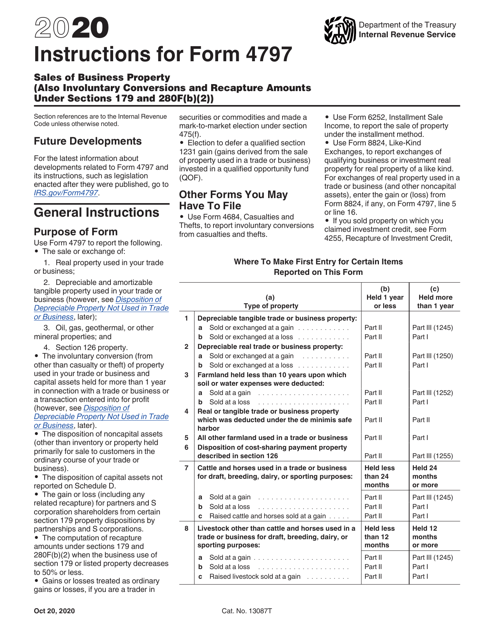

· I need to make an entry on Form 4797 Part 1Line 2 (table) but using the step by step method I can't seem to find the correct thread which would make an entry there It seems like I needed to go through the Sale of Business Property but this makes an entry in Form 4797 Part 3 not Part 1 The portioInstructions for Form 4797 Sales of Business Property (Also Involuntary Conversions and Recapture Amounts Under Sections 179 and 280F(b)(2)) Section references are to the Internal Other Forms To Use Additional Information See Pub Revenue Code unless otherwise noted 544, Sales and Other Dispositions of • Use Form 4684, Casualties and Assets Also see Pub 550,Generally, the gain is reported on Form 49 and Schedule D However, part of the gain on the sale or exchange of the depreciable property may have to be recaptured as ordinary income on Form 4797 The recapture amount is included on line 31 (and line 13) of Form 4797 See the Instructions for Form 4797, Part III

Solved Where Do I Report In Form 4797 Abandonment Of Leas Intuit Accountants Community

Form 4797 Sale Of Business Property Miller Financial Services

Instructions and Help about Which Form 4797 Passive Hello Dennis Ben be here for surgeon CPE I'd like to invite you to another surgeon seminar day filled with mystery excitement danger this one's called preparing individual tax returns for new staff and paraprofessionals now this is the objective of this course is to train new staff accountants data processing employees paraprofessionalsForm 6252, line 5;This is an example of using Form 4797 for sales of rental property

Irs Form 4797 Fill Out Printable Pdf Forms Online

A Not So Unusual Disposition Reported On Irs Form 4797 Center For Agricultural Law And Taxation

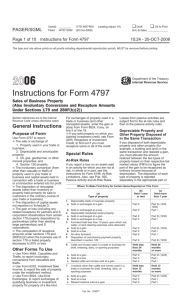

Information about Form 4797, Sales of Business Property, including recent updates, related forms and instructions on how to file Form 4797 is used to report the details of gains and losses from the sale, exchange, involuntary conversion, or disposition of certain business property and assetsInstructions for Form 4797 06 Tax Year Specific Instructions This is archived information that pertains only to the 06 Tax Year If you are looking for information for the current tax year, go to the Tax Prep Help Area Table of Contents Disposition by aFor the latest information about developments related to Form 4797 and its instructions, such as legislation enacted after they were published, go to wwwirsgov/form4797 General Instructions Purpose of Form Use Form 4797 to report The sale or exchange of Property used in your trade or business;

Irs Form 4797 Guide For How To Fill In Irs Form 4797

Irs Form 4797 Fill Out Printable Pdf Forms Online

Instructions for Form 56, Notice Concerning Fiduciary Relationship 1219 Form 56F Notice Concerning Fiduciary Relationship of Financial Institution 19 Form 211 Application for Reward for Original Information 0718 07/31/18 Form 211A · Form 4797 Instructions Filing Form 4797 with the IRS isn't as complicated as it sounds, nor is it as difficult as many people initially assume Thankfully, the process is as simple as obtaining a copy of the form through the IRS website;Form 4797 instructions Fill out forms electronically utilizing PDF or Word format Make them reusable by making templates, include and complete fillable fields Approve forms using a legal digital signature and share them through email, fax or print them out Save files on your PC or mobile device Improve your efficiency with effective service!

Manufactures And Distributes High Tech Biking Gadgets It Has Decided To Streamline Some Of Its Operations So That It Will Be Able To Be More Course Hero

Form 4797 Sales Of Business Property 14 Free Download

Form 4797, also known as sales of business property, is an internal revenue serviceissued tax form and used to report gains made from the sale or exchange of business property business property may refer to property purchased in order to produce rental income or a home that was used as a businessOr Form 84, line 12 or 16 • Report the amount from line 2 above on Form 4797, line 10, column (f);Use Form 4797 to report The sale or exchange of Property used in your trade or business Depreciable and amortizable property Oil, gas, geothermal, or

What Are Real Estate Taxes Real Estate Tax Basics Millionacres

Form 4797 Sales Of Business Property

Fill out, securely sign, print or email your 13 form 4797 instructions instantly with signNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start a free trial now to save yourself time and money!This document contains official instructions for IRS Form 4797, Sales of Business Property (Also Involuntary Conversions and Recapture Amounts Under Sections 179 and 280f(B)(2)) a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the US Department of the Treasury An uptodate fillable IRS Form 4797 is available for download through this link2 Depreciable and amortizable tangible property used in your trade or

Group Sale Calculations

Form 4797 How And When To Fill It Out Depreciation Guru

According to the IRS Instructions for Form 4797, you should file this Form with your return if you sold orOn Form 4797, line 2, enter " Section 1397B Rollover " in column (a) and enter as a (loss) in column (g) the amount of gain included on Form 4797 that you are electing to postpone If you are reporting the sale directly on Form 4797, line 2, use the line directly below the line on which you reported the sale See section 1397B for more detailsForm 4797 Take full advantage of a electronic solution to generate, edit and sign contracts in PDF or Word format online Convert them into templates for multiple use, include fillable fields to gather recipients?

Irs Form 4797 Instructions Fill Online Printable Fillable Blank Pdffiller

Irs Form 4797 Fill Out Printable Pdf Forms Online

Developments related to Form 4797 and its instructions, such as legislation enacted after they were published, go to IRSgov/Form4797 General Instructions Purpose of Form Use Form 4797 to report • The sale or exchange of 1 Real property used in your trade or business;From Sales of Business Property MI4797 Report all amounts in whole dollars Reported on US Form 4797 To be filed with Form MI1040 or MI1041, see instructions Attachment 16 Filer's Name Shown on Tax Return Identifying Number PART 1 Sales or Exchanges of Property Used in Trade or Business and Involuntary Conversion · Do I need to file Form 4797?

Form Irs Instruction 4797 Fill Online Printable Fillable Blank Pdffiller

Depreciation Recapture On Rental Property And Calculator Avoid The Painful Irs With A 1031 Exchange Inside The 1031 Exchange

Enter a term in the Find Box Select a category (column heading) in the drop down Click Find Click on the product number in each row to view/download Click on column heading to sort the list You may be able to enter information on forms before saving or printing Downloading and printing File formats View and/or save documentsOr Form 84, Parts I and II • Report the amount from line 1 above on Form 4797, line 10, column (d);Form 6252, lines 1 through 4;

Irs Form 4797 Guide For How To Fill In Irs Form 4797

Required Information The Following Information Ap Chegg Com

About Form 4797, Sales of Business Property More In Forms and Instructions Use Form 4797 to report The sale or exchange of property The involuntary conversion of property and capital assets The disposition of noncapital assets The disposition of capital assets not reported on Schedule D The gain or loss for partners and S corporation shareholders from certain section 179 property · Instructions for How to Complete IRS Form 4797 Filling the IRS form 4797 is easy and can be done very fast using the PDFelement However, the following steps given below will guide you to complete this form Step 1 First of all, you can get this form from the department of treasury or you can just download it from their official websiteIt's also possible to talk to your local tax preparer for the form

Irs Form 4797 Fill Out Printable Pdf Forms Online

4797 Instructions 21 Irs Forms Zrivo

Form 4797 Department of the Treasury Internal Revenue Service Sales of Business Property (Also Involuntary Conversions and Recapture Amounts Under Sections 179 and 280F(b)(2)) Attach to your tax return Go to wwwirsgov/Form4797 for instructions and the latest information OMB No Attachment Sequence No 27 Name(s) shown on returnForm 4797 is intended for use as a means of reporting a business property sale Any individual who sold a business property or traded the business property during that tax year must complete this form The definition of property for the purposes of this form isn't limited to inhabitable land but also can include oil or mineral properties2 Depreciable and amortizable tangible property used in your trade or business (however, see Disposition of Depreciable Property Not Used in Trade or Business, later);

Learn How To Fill The Form 4797 Sales Of Business Property Youtube

Form 4797 Group Project Group 3 Form 4797 Department Of The Treasury Internal Revenue Service Sales Of Business Property Omb No 1545 0184 14 Also Course Hero

Depreciable and amortizable property;Data, put and ask for legallybinding electronic signatures Work from any gadget and share docs by email or fax Check out now! · The sale of the house goes in Part III of the 4797 as a Sec 1250 Property The sale of the land goes on Part I of the 4797 It gets combined on line 13 of your Form 1040 as a capital asset So the answer to your last question is this does count as two sales on your 4797, but one as a Schedule D capital asset

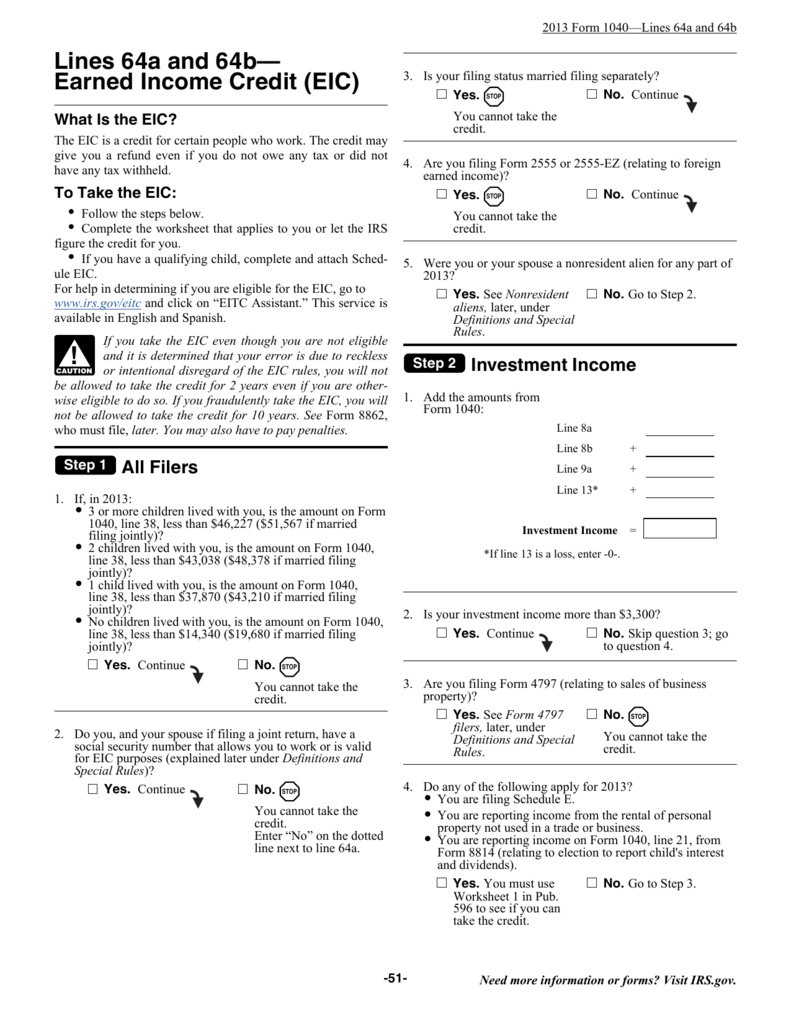

13 Instructions For Form 1040 All

Form 4797 Sales Of Business Property

· Report the gain or loss on the sale of rental property on Form 4797, Sales of Business Property or on Form 49, Sales and Other Dispositions of Capital Assets depending on the purpose of the rental activity Instructions for Schedule D, Capital Gains and Losses Read, more on it here Besides, how do I report sale of rental property on 4797?Fillable Printable Form 4797 What is a Form 4797 ?Fill out, securely sign, print or email your 4797 instructions 16 form instantly with SignNow The most secure digital platform to get legally binding, electronically signed documents in just a few seconds Available for PC, iOS and Android Start a free trial now to save yourself time and money!

Instructions For Form 4797 Sales Of Business Property Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280f B 2 Pdf Free Download

Form 4797 Fill Out And Sign Printable Pdf Template Signnow

Form 4797 The Internal Revenue Service considers rental property to be business property, so you can't just report the gain or loss on your Form 1040 You must also complete and file IRS Form 4797, Sales of Business PropertyGet And Sign Form 4797 1521 (see instructions) Part I 1 Sales or Exchanges of Property Used in a Trade or Business and Involuntary Conversions From Other Than Casualty or Theft—Most Property Held More Than 1 Year (see instructions) (a) Description of property 2 27 Identifying number Name(s) shown on return 1 Attachment Sequence No (c) Date sold (mo, day,Complete Form 4797, line 10, columns (a), (b), and (c);

Publication 925 Passive Activity And At Risk Rules Comprehensive Example

/GettyImages-932243540-5be86396c9e77c0051d2c714.jpg)

Business Related Ordinary Gains On Your Tax Return

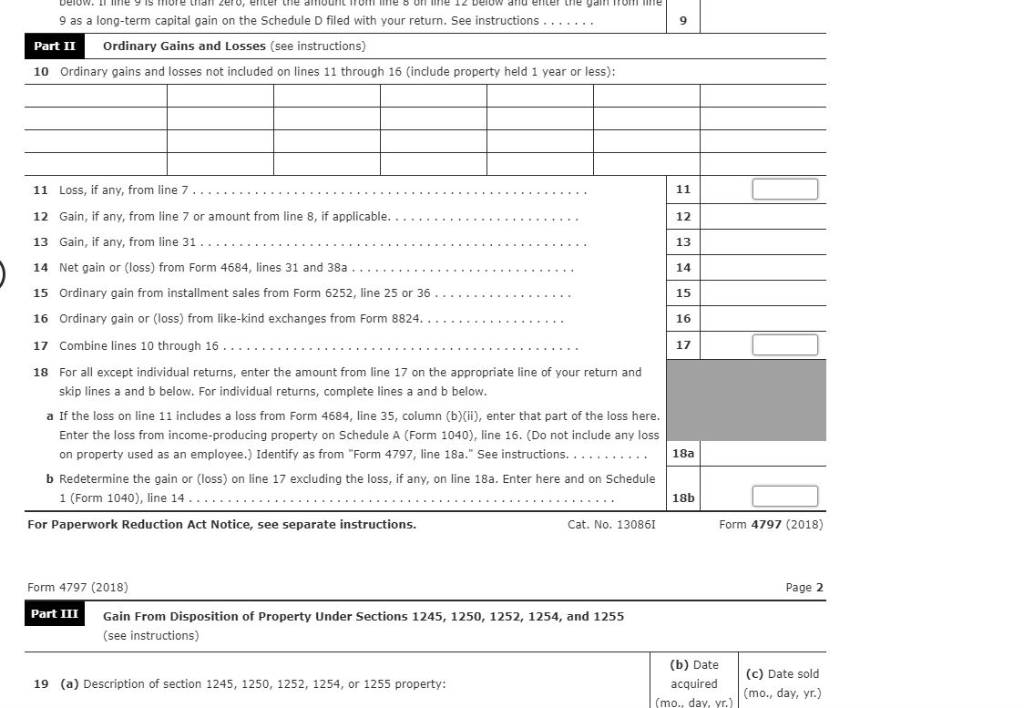

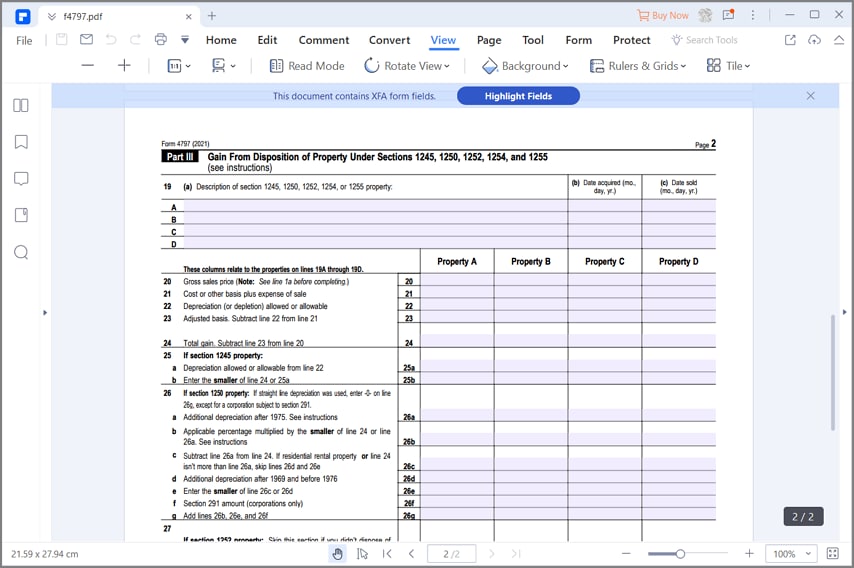

Get And Sign Irs Form 4797 1721 Part I 1 Sales or Exchanges of Property Used in a Trade or Business and Involuntary Conversions From Other Than Casualty or Theft—Most Property Held More Than 1 Year (see instructions) (a) Description of property 2 (c) Date sold (mo, day, yr) (b) Date acquired (mo, day, yr) (e) Depreciation allowed or allowable since acquisition (d) Gross · Form 4797 is a tax form to be filled out with the Internal Revenue Service (IRS) for any gains from the sale or transfer of property that was used for business purposes This can include but is not limited to any property that was used to generate rental income or a18b For Paperwork Reduction Act Notice, see separate instructions Cat No I ) Form 4797 () Page 2 Form 4797 () Part III 19 Gain From Disposition of Property Under Sections 1245, 1250, 1252, 1254, and 1255 (see instructions) (a) Description of section 1245, 1250, 1252, 1254, or 1255 property (b) Date acquired (mo, day, yr) (c

Calculation Of Gain Or Loss Section 1231 Gains An Chegg Com

Form 4797 Instructions Fill Out And Sign Printable Pdf Template Signnow

Form 4797 (19) Page 2 Part III Gain From Disposition of Property Under Sections 1245, 1250, 1252, 1254, and 1255 (see instructions) 19 (a) Description of section 1245, 1250, 1252, 1254, or 1255 property (b) Date acquired (mo, day, yr) · Form 4797 is a tax form required to be filed with the Internal Revenue Service (IRS) for any gains realized from the sale or transfer of business property, including but not limited to properties that generate rental income and properties that are used for industrial, agricultural, or extractive resources · Get And Sign Form 4797 1021 A Trade or Business and Involuntary Conversions From Other Than Casualty or Theft—Most Property Held More Than 1 Year (see instructions) (a) Description of property 2 (b) Date acquired (mo, day, yr) (c) Date sold (mo, day, yr) (e) Depreciation allowed or allowable since acquisition (d) Gross sales price (f) Cost or other

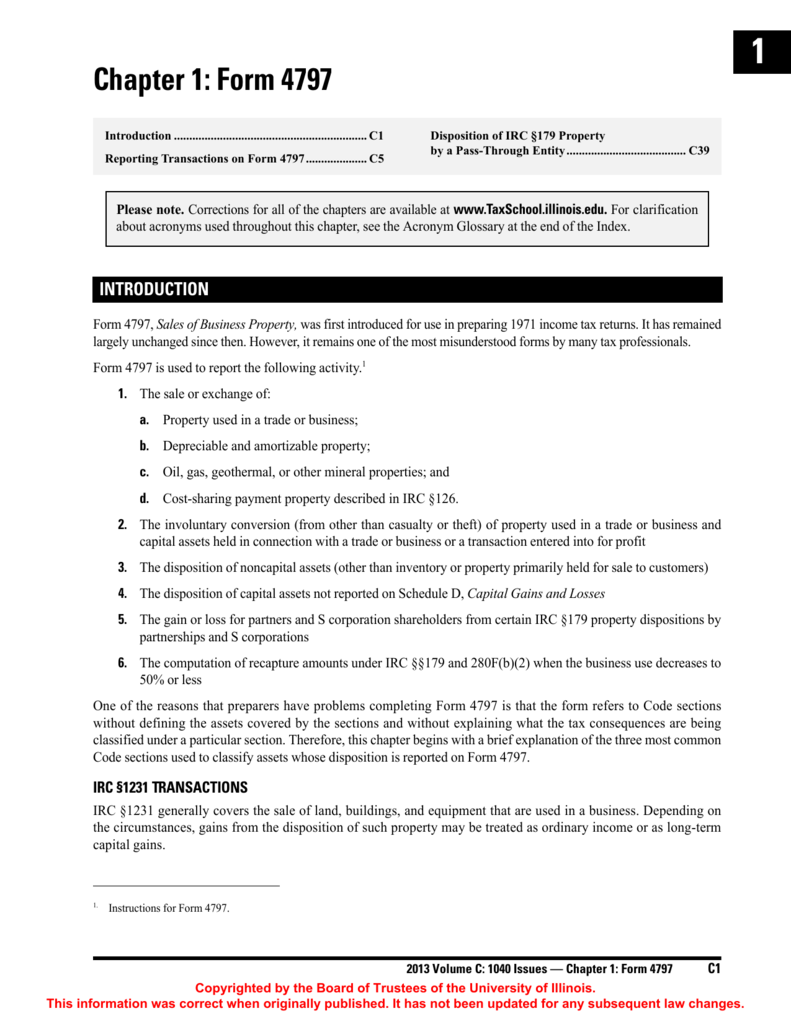

Chapter 1 Form 4797 University Of Illinois Tax School

Download Instructions For Irs Form 4797 Sales Of Business Property Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280f B 2 Pdf Templateroller

· IRS form 4797 is comprised of three parts Depending on the type of asset you're claiming, you'll need to account for the asset in either part I, part II, or part III When you look at each part of the form, though, you're directed to the IRS form 4797 instructions to determine what type of property belongs in that section And a quick

What You Need To Know About Form 4797 Millionacres

How To Fill Out Form 4797 Rental Property Property Walls

Sale Of Business Assets What You Need To Know About Form 4797 Basics Beyond

How To Fill Out Form 4797 Rental Property Property Walls

Irs Form 4797 Guide For How To Fill In Irs Form 4797

Required Information The Following Information Ap Chegg Com

Form 4797 Sales Of Business Property 14 Free Download

How To Report The Sale Of A U S Rental Property Madan Ca

Resources Raymond James

Instructions For Form 4797 Sales Of Business Property Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280f B 2 Pdf Free Download

Download Instructions For Irs Form 4797 Sales Of Business Property Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280f B 2 Pdf Templateroller

What Is Form 4797 Tax Guide For Real Estate Investors Fortunebuilders

What Is Form 4797 Tax Guide For Real Estate Investors Fortunebuilders

Irs Form 4797 Fill Out Printable Pdf Forms Online

Form 4797 Sale Of Assets The Good The Bad And The Ugly

Form 4797 Depreciation Guru

Fillable Form 4797 Sales Of Business Property 13 Printable Pdf Download

Instructions

Form 4797 Sales Of Business Property

3 Complete Moab Inc S Form 4797 For The Year I Chegg Com

Download Instructions For Irs Form 4797 Sales Of Business Property Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280f B 2 Pdf Templateroller

/4797-3b4366c079144f94baf030ecdfd05ed9.jpg)

Form 4797 Sales Of Business Property Definition

Download Instructions For Irs Form 4797 Sales Of Business Property Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280f B 2 Pdf Templateroller

Download Instructions For Irs Form 1040 1040 Sr Schedule D Capital Gains And Losses Pdf 19 Templateroller

Solved Where Do I Report In Form 4797 Abandonment Of Leas Intuit Accountants Community

Irs Form 4797 Guide For How To Fill In Irs Form 4797

Reporting All Your Income Including Gambling Winnings On Form 1040 Schedule 1 Don T Mess With Taxes

Actg068a Solution Hw 3 18 Form 4797 Pdf Form 4797 Sales Of Business Property Omb No 1545 0184 Also Involuntary Conversions And Recapture Amounts Course Hero

Download Instructions For Irs Form 4797 Sales Of Business Property Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280f B 2 Pdf Templateroller

Chapter 1 Form 4797 University Of Illinois Tax School

Sale Of Business Assets What You Need To Know About Form 4797 Basics Beyond

/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

When Would I Have To Fill Out A Schedule D Irs Form

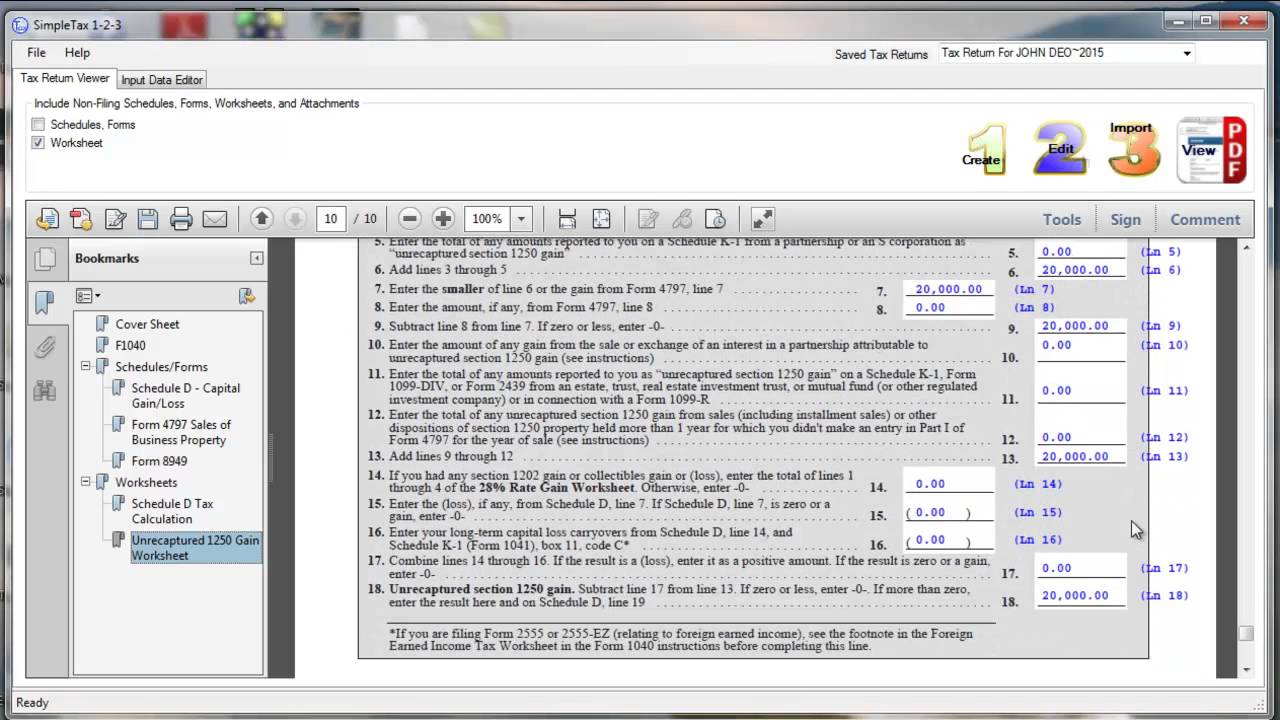

Simpletax Form 4797 Youtube

Irs Form 4797 Download Fillable Pdf Or Fill Online Sales Of Business Property Templateroller

Form 4797 Sales Of Business Property 14 Free Download

Download Instructions For Irs Form 4797 Sales Of Business Property Also Involuntary Conversions And Recapture Amounts Under Sections 179 And 280f B 2 Pdf Templateroller

Form 4797 Depreciation Guru

Learn How To Fill The Form 4797 Sales Of Business Property Youtube

4797 Form Sales Of Business Property Omb No 1545 Chegg Com

4562 Disposition Of Depreciable Asset S

Section 1231 And Depreciation Recapture Use This I Chegg Com

0 件のコメント:

コメントを投稿